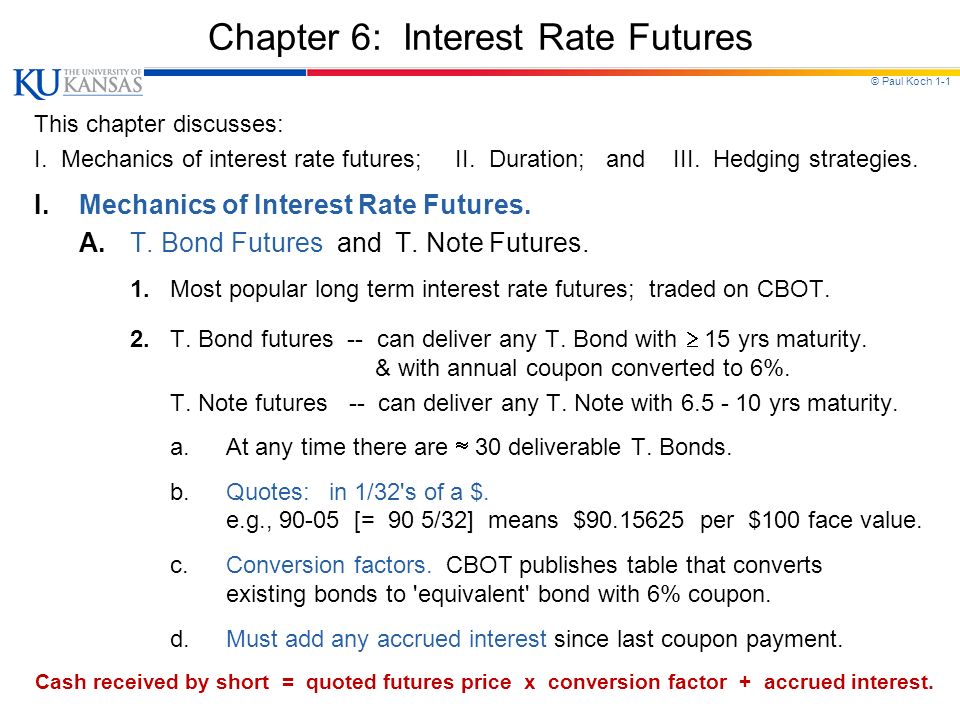

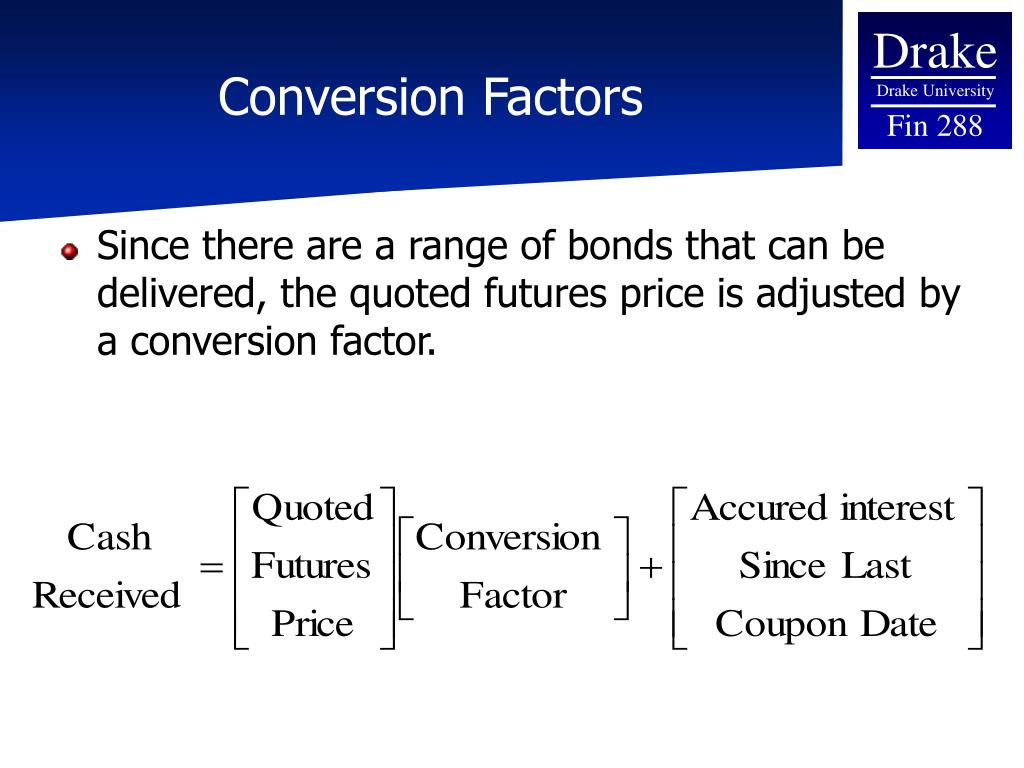

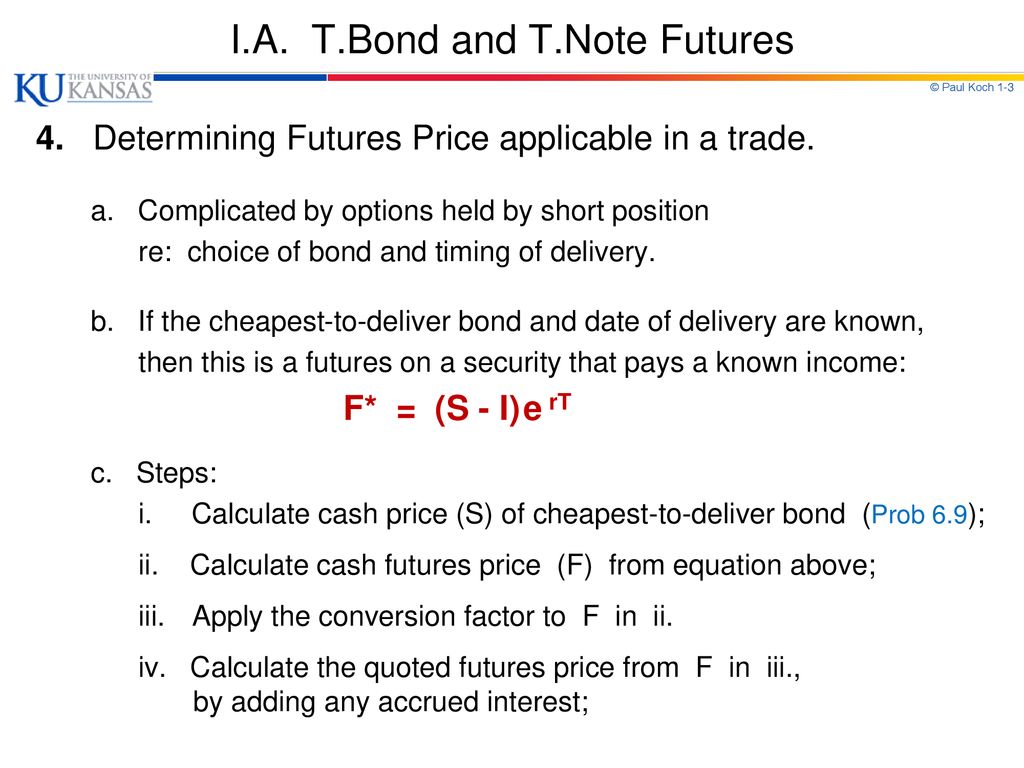

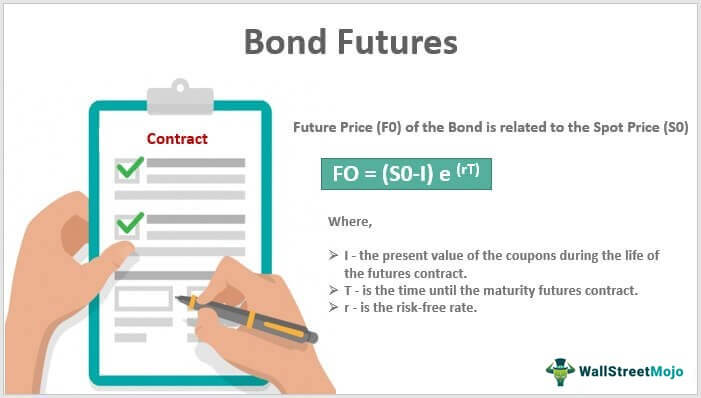

Lecture 7. Topics Pricing Delivery Complications for both Multiple assets can be delivered on the same contract…unlike commodities The deliverable. - ppt download

Lecture 7. Topics Pricing Delivery Complications for both Multiple assets can be delivered on the same contract…unlike commodities The deliverable. - ppt download

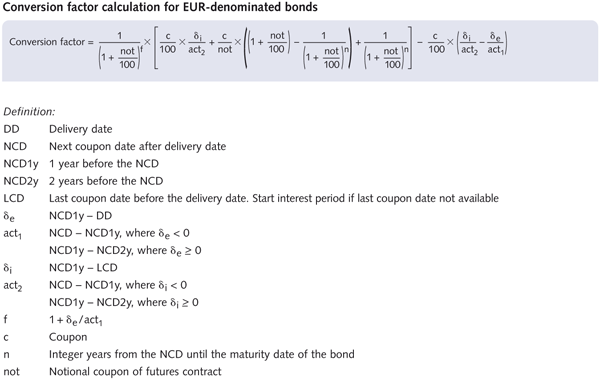

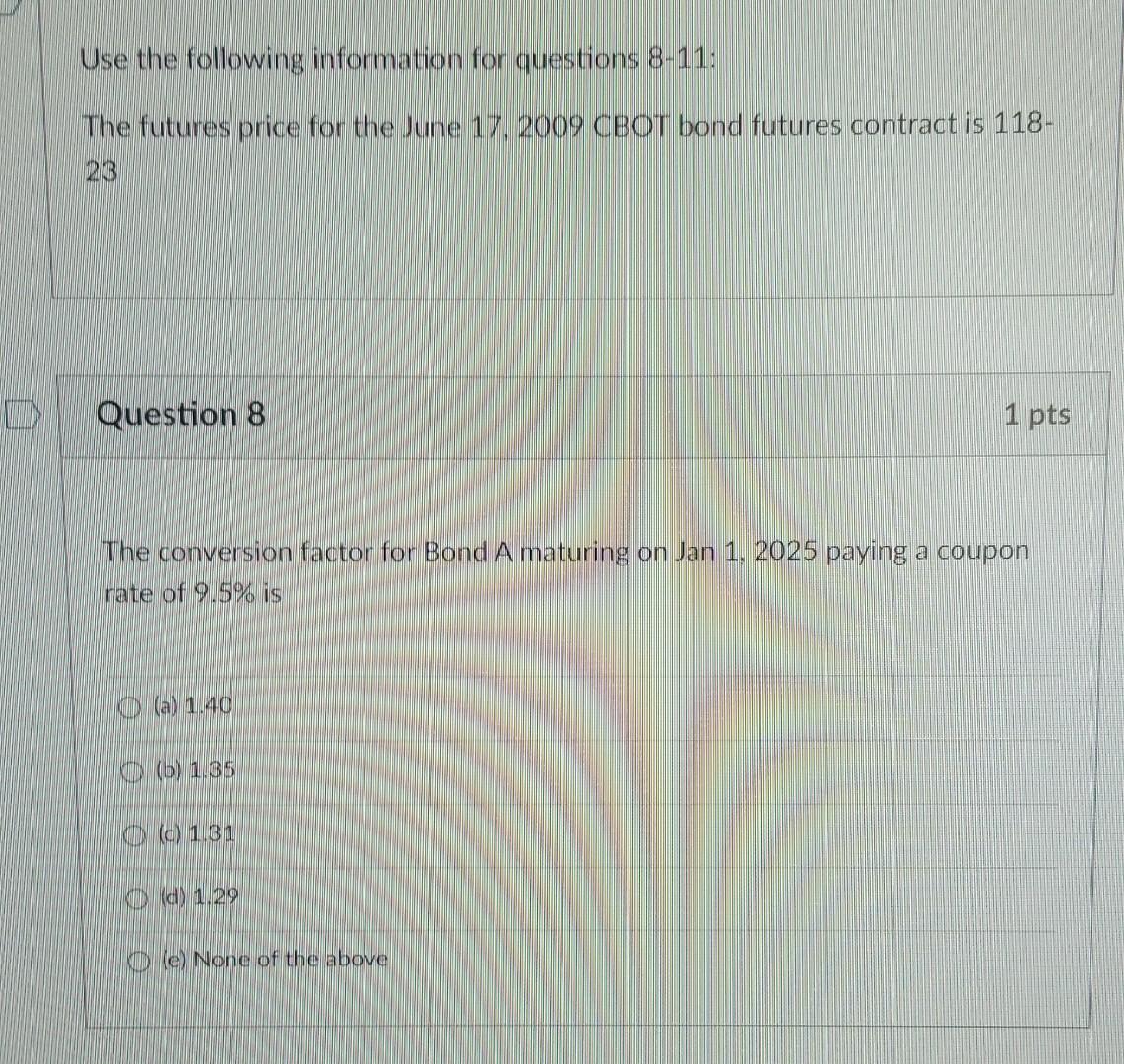

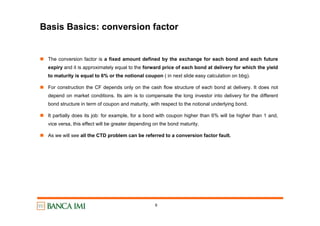

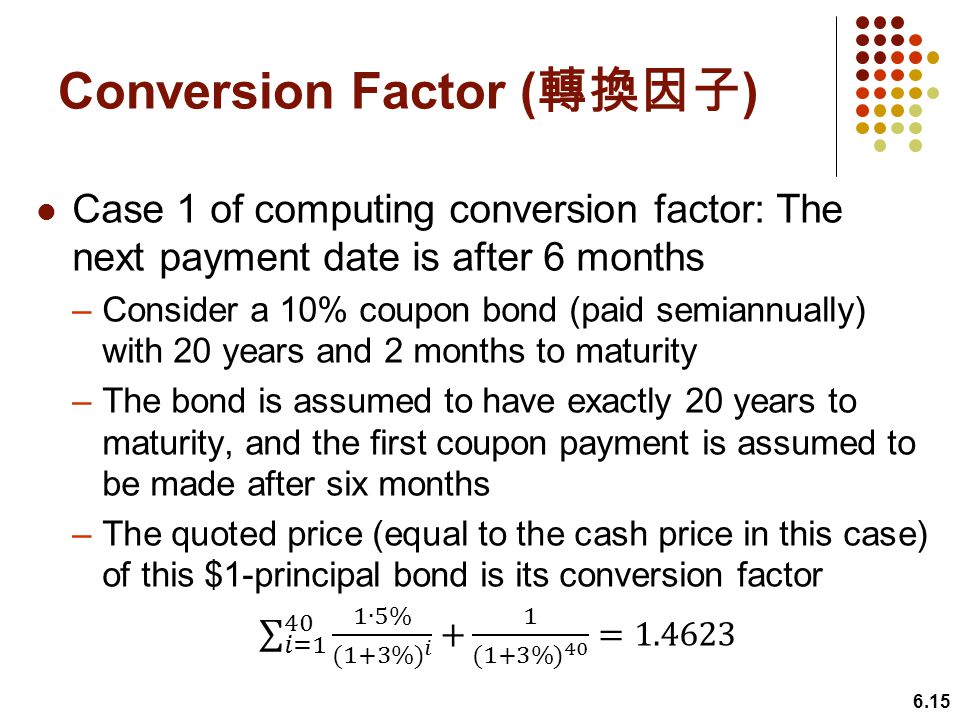

Calculating U.S. Treasury Futures Conversion Factors Final Dec 4 | PDF | Futures Contract | United States Treasury Security

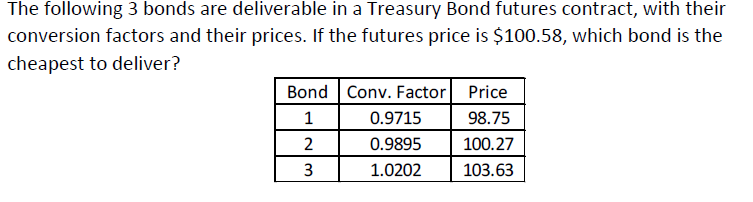

P1.T3.720. US Treasury bonds: conversion factors, cheapest-to-deliver & theoretical futures price | Forum | Bionic Turtle

Intuition and reasoning behind conversion factor calculation for bond futures - Quantitative Finance Stack Exchange