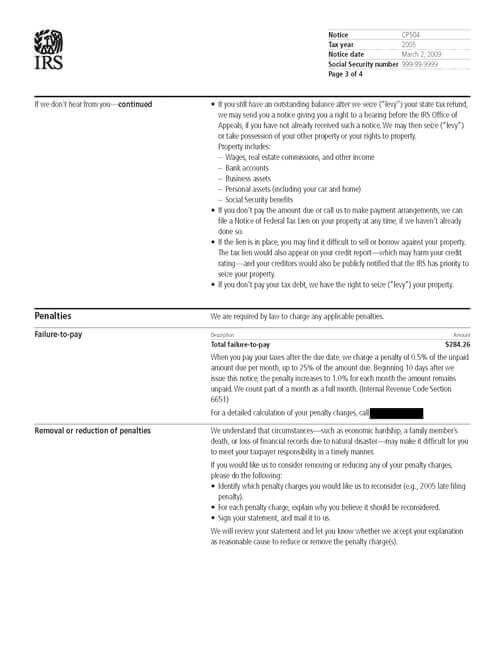

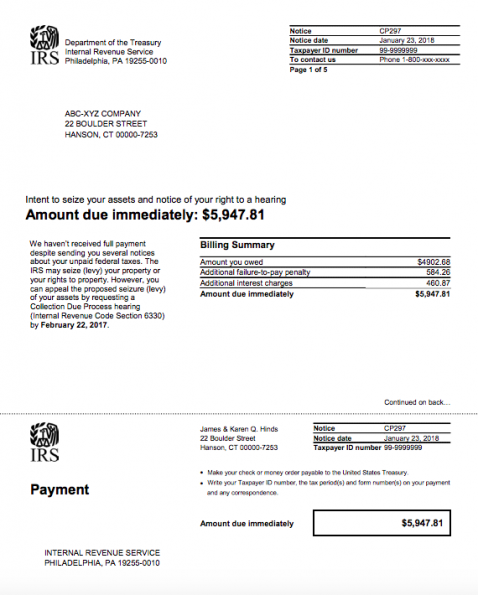

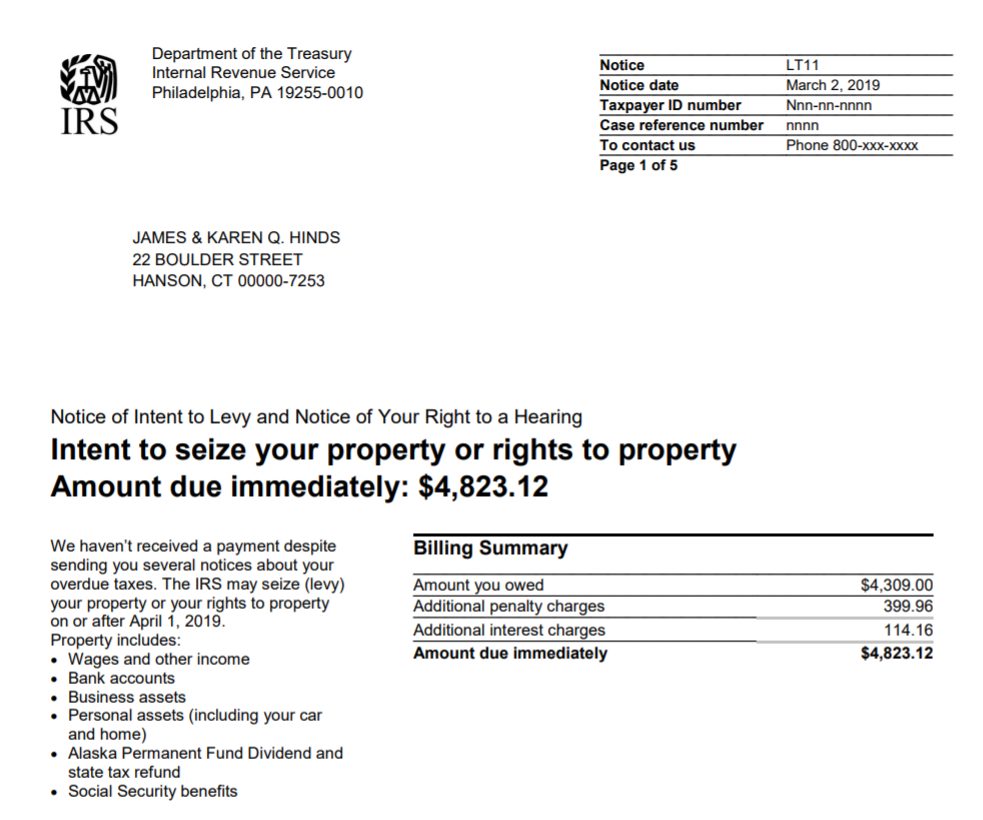

IRS Just Sent Me a Notice of Intent to Seize (Levy) Your Property or Right to Property (CP 504) – What Should I Do? | Legacy Tax & Resolution Services

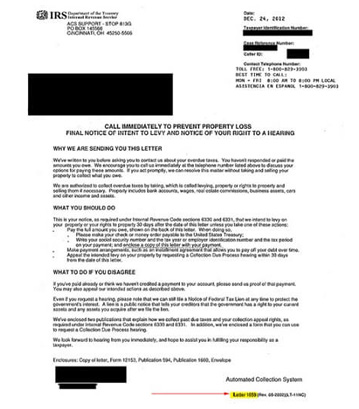

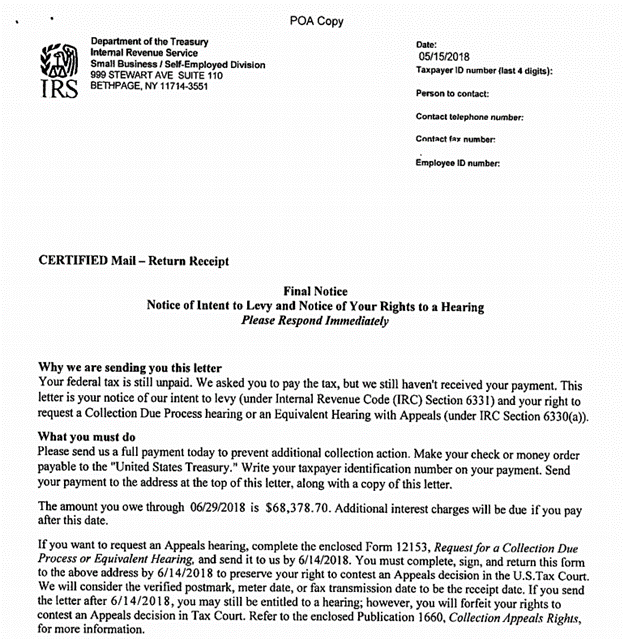

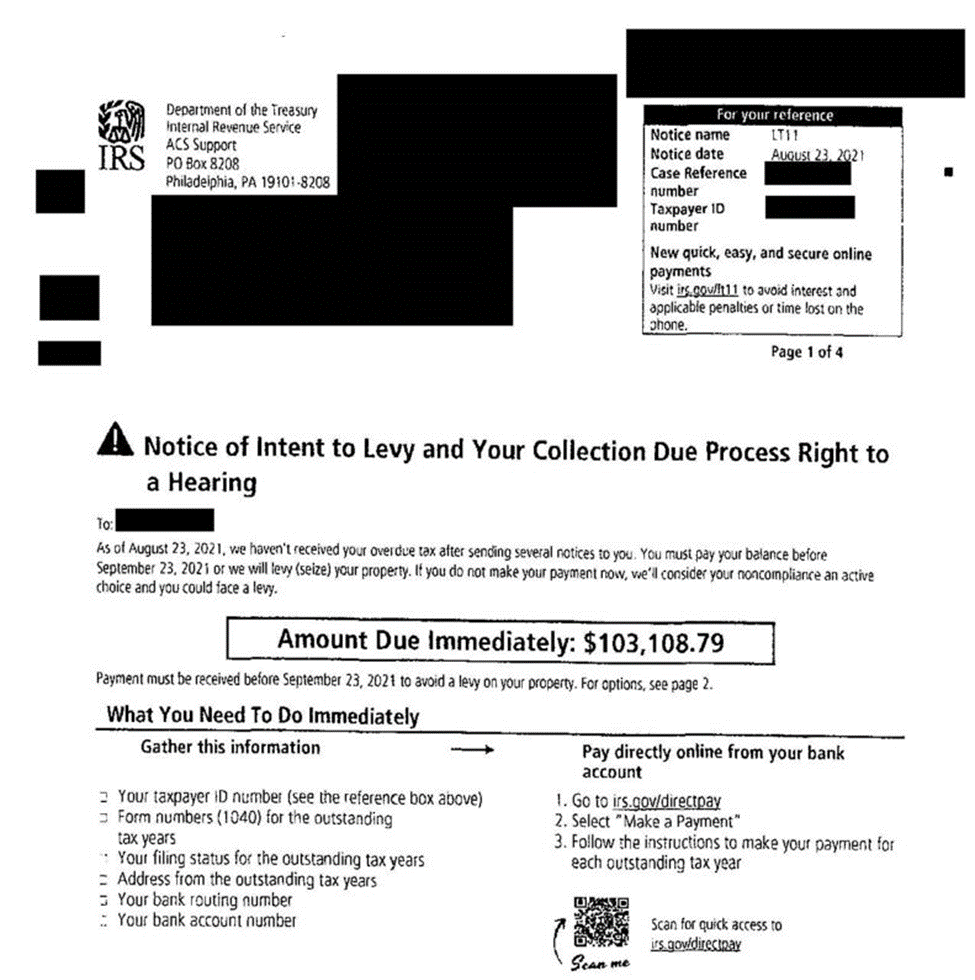

IRS Demand Letters: What are They and What You Need to Know | Tax Resolution Professionals, A Nationwide Tax Law Firm, (888) 515-4829