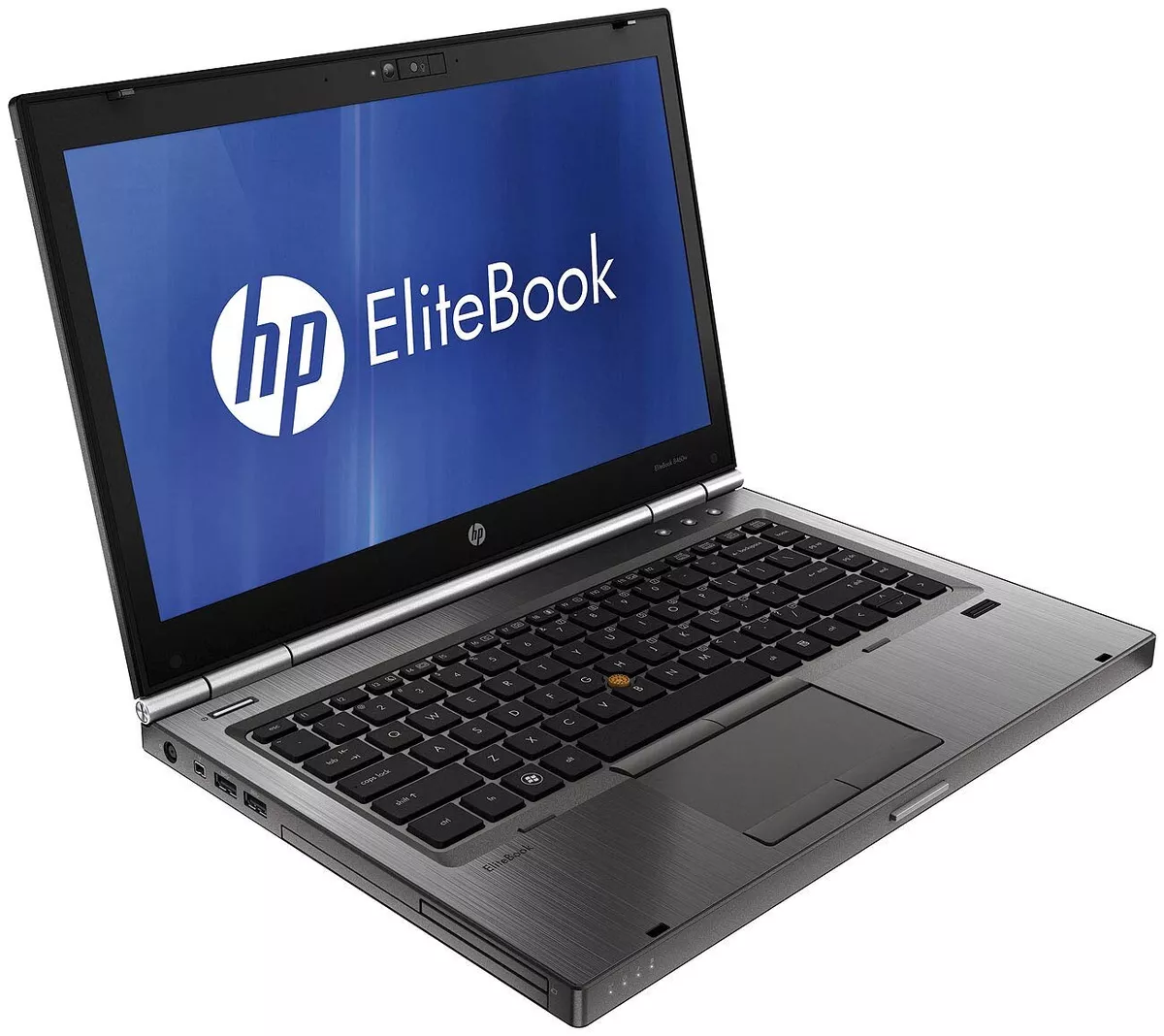

Kocoqin Laptop Motherboard For Hp Elitebook 8560w Qm67 4 Ram Slots Mainboard 685518-001 685518-501 010164g00 Slj4p - Laptop Motherboard - AliExpress

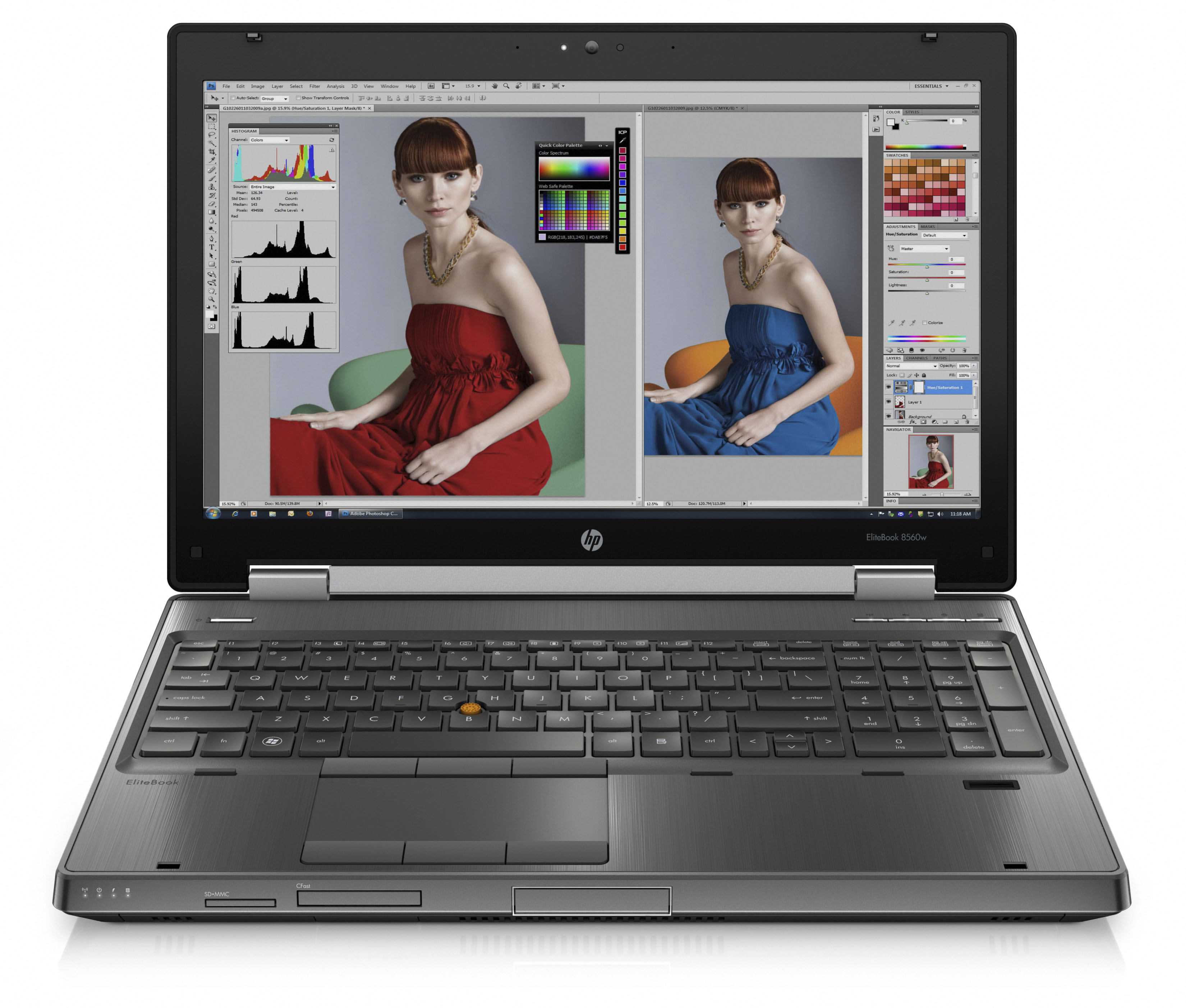

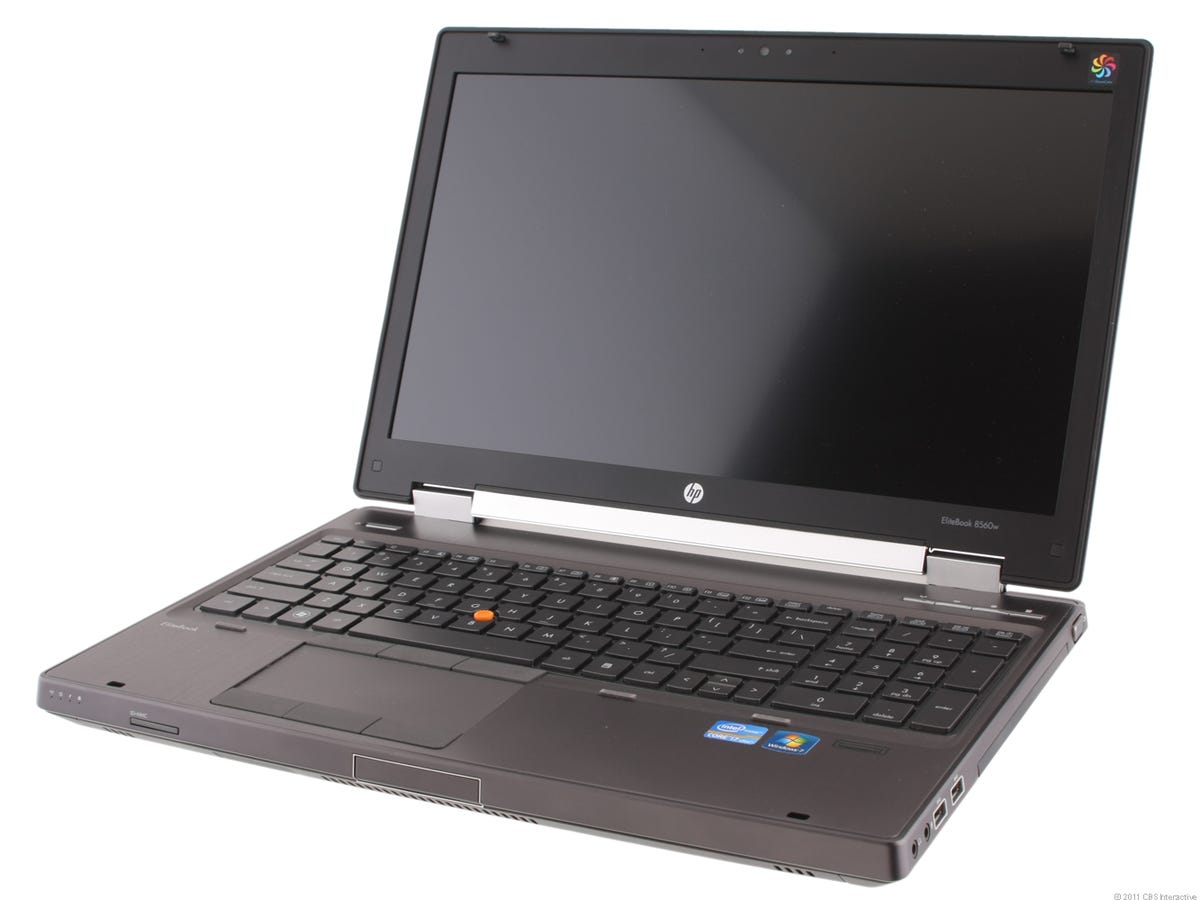

HP EliteBook Mobile Workstation 8560w - Core i7-2720QM 2.2GHz - 15.6-inch TFT review: HP EliteBook Mobile Workstation 8560w - Core i7-2720QM 2.2GHz - 15.6-inch TFT - CNET

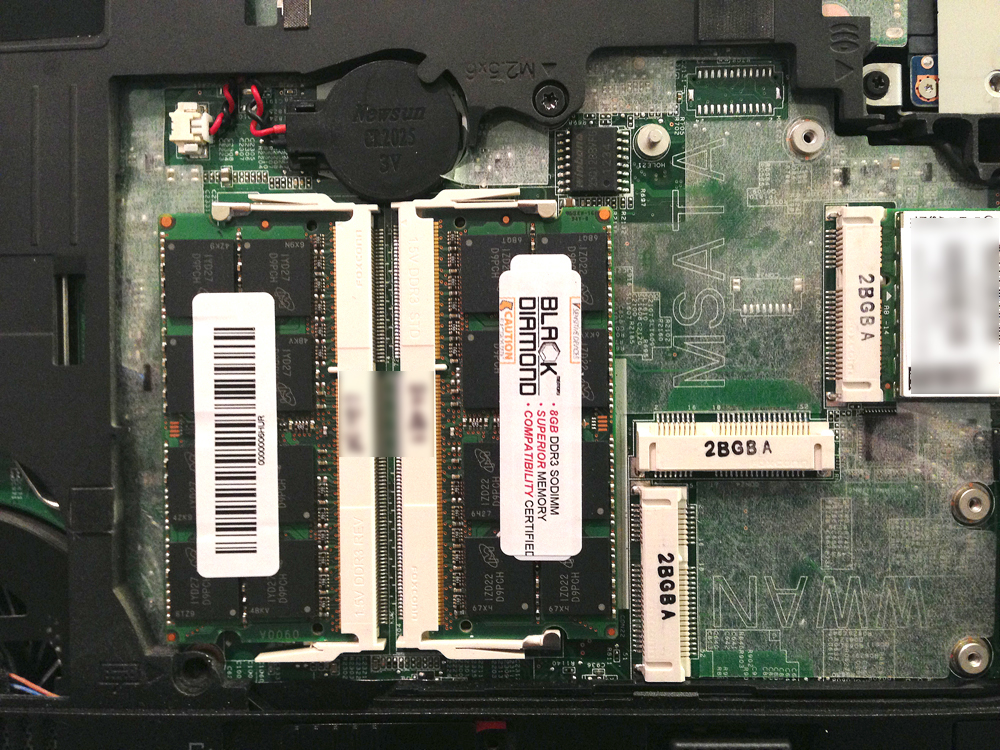

parts-quick 16GB 2X 8GB Memory for HP EliteBook 8560p 8560w 8570p 8760w DDR3 PC3-10600 1333MHz 204 pin SODIMM RAM at Amazon.com

CMS 32GB (4X8GB) DDR3 10600 1333MHZ NON ECC SODIMM Memory Ram Upgrade Compatible with HP/Compaq® Elitebook 8560W Quad Core - C12 System Specific Memory - Newegg.com

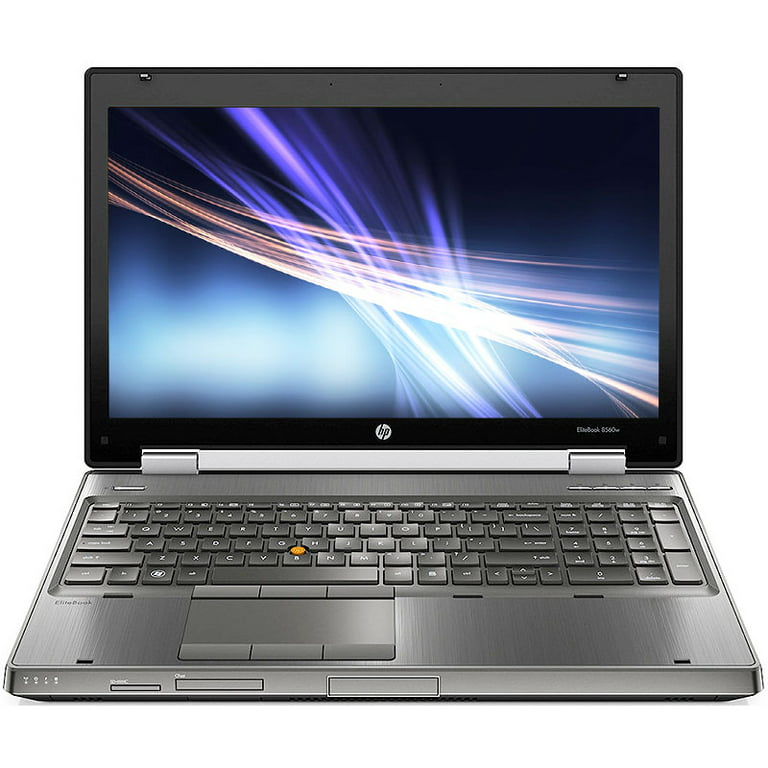

HP Elitebook 8560w Workstation – 8GB Ram – 500GB HDD – Intel Core i7 – 2GB Dedicated Graphics - PSERO LAPTOP